How to Value & Sell a Website with No Revenue with Flippa?

People are selling brand-new e-commerce sites with zero sales, zero traffic, and zero revenue for $3,500 on Flippa. I’ve analyzed over 200 listings to understand how this works. Here’s everything you need to know about valuing and selling websites that make no money.

The uncomfortable truth: you don’t need revenue to sell a website. You need something buyers want more than money. Time.

Why Flippa Works for Zero-Revenue Sites

Flippa isn’t just for profitable businesses. I’ve watched dozens of zero-revenue sites sell in the $2,000-$5,000 range. The platform attracts buyers looking for:

Time savings. Building a professional site takes 3-6 weeks. Buyers skip this entirely by purchasing ready-made sites. One listing sold for $3,500 even though it had never processed a single order. The buyer wanted a turnkey e-commerce store without the setup headache.

SEO foundation. A six-month-old domain with clean backlinks and indexed pages beats starting from scratch. Domain Authority matters more to buyers than current traffic. I’ve seen sites with DA 15-20 sell for premium prices because buyers know building that authority takes months.

Professional design. Most people can’t design a clean, conversion-optimized site. They’re paying for skills they don’t have. A properly built WooCommerce store with product pages, checkout flow, and mobile responsiveness is worth money regardless of sales.

Market entry speed. Entrepreneurs testing new markets don’t want to spend six weeks building infrastructure. They want to launch campaigns tomorrow. Your zero-revenue site becomes their shortcut.

Flippa’s marketplace connects these buyers with sellers. The platform processed thousands of site sales in 2025, including hundreds with minimal or zero revenue. The free valuation tool now accounts for pre-revenue sites in its calculations.

How to Value Your No-Revenue Website

Traditional valuation multiples don’t work without profit. Here’s what does.

The Official Flippa Approach

Flippa’s valuation tool requires minimum inputs of $50 annual revenue and $50 annual expenses. This creates a zero-profit scenario the algorithm can process. I tested this with multiple domains. The tool valued a zero-profit site at $1,000 based purely on age, traffic potential, and domain quality.

That $1,000 is your floor. Not your ceiling.

The calculator uses data from thousands of similar transactions. It considers business model, category, site age, and buyer demand for sites like yours. Content websites typically sell for 25-40× monthly profit, but the algorithm adjusts for non-revenue factors: traffic volume and trend, niche category, primary revenue potential, content quality, additional assets, domain age, traffic diversification, backlink quality, and weekly maintenance requirements.

You’ll get your valuation instantly. Save it, share it, use it as negotiation starting point. But don’t stop there.

What the Tool Doesn’t Account For

Domain Authority. Sites with good DA (15+) sell for significantly more than the basic valuation. Buyers know they can’t manufacture authority. A clean 12-month-old domain with natural backlinks adds $500-1,500 to your asking price.

Technical Setup. A properly configured site with SSL, fast hosting, clean code, and mobile optimization demonstrates professionalism. Buyers pay for this. I’ve seen identical niche sites sell for 40% different prices based purely on technical quality.

Content Quality. Ten well-written, SEO-optimized articles beat fifty scraped posts. Buyers evaluate whether they could hit publish on your content or need to rewrite everything. Original content with proper headings, meta descriptions, and internal linking structure increases value.

Email List Potential. Even a basic opt-in form with zero subscribers shows you’ve built lead capture infrastructure. Buyers recognize this saves them setup time.

Visual Assets. Logo files, banner images, product mockups, and brand guidelines add tangible value. These cost money to create. Buyers appreciate when they’re included.

Comparable Sales Method

Search completed Flippa auctions in your niche. Filter by:

- Similar business model (content site, e-commerce, SaaS)

- Comparable age (within 6 months)

- Similar traffic level (or both under 1,000 monthly visitors)

- Same revenue bracket (zero to minimal)

I found brand-new e-commerce sites consistently selling in the $2,000-$3,500 range. Content sites with 20+ articles but no traffic sold for $800-$1,500. SaaS products with working code but zero users went for $1,500-$4,000.

Your site should fall somewhere in these ranges unless you have exceptional domain authority or unique technical assets.

The Time-Investment Calculation

Calculate how long building your site took. Value your time honestly:

- Domain research and purchase: 2 hours

- Site setup and hosting: 3 hours

- Design customization: 10-15 hours

- Content creation: 20-40 hours (if quality content exists)

- Technical optimization: 5-10 hours

- Testing and debugging: 5 hours

Total: 45-75 hours of work. At a modest $25/hour freelance rate, that’s $1,125-$1,875 in labor alone. Add domain cost ($12), hosting ($60 annual), theme ($50-100), plugins ($50-200), and you’re at $1,300-$2,200 in real investment.

This becomes your justification floor. You’re not selling revenue. You’re selling invested time and money.

Discounted Cash Flow for Pre-Revenue Sites

This works when you can demonstrate realistic future earnings. Don’t make up numbers. Use industry benchmarks.

Content sites in established niches with 50+ quality articles can reasonably project $200-500 monthly earnings within 6-12 months through ads and affiliates. E-commerce stores in validated niches with product pages and payment processing can project $500-1,500 monthly within 6 months with proper marketing.

Buyers discount these projections heavily because execution risk is high. A projected $3,000 annual profit might support only a $1,500-2,000 valuation for a zero-revenue site.

Only use this method if you have specific, defensible projections. Vague “could make money” claims harm credibility.

Building Value Before Listing

You’re starting with zero revenue. These improvements add $500-$2,000 to your asking price.

Content Development

Twenty high-quality articles beat five. But quality matters more than quantity. I’ve seen ten exceptional articles outperform fifty mediocre ones in sale price.

Target: 15-25 articles, 1,500-2,500 words each, properly optimized for search intent. Include keyword research documentation so buyers see your planning. Screenshot your keyword targets and search volume data. This proves you’ve done strategic work, not random writing.

Write for humans first, search engines second. Buyers evaluate whether they’d publish your content as-is. Poorly written SEO spam destroys value faster than having no content at all.

SEO Foundation

Submit to Google Search Console. Request indexing for all important pages. Even if you have zero traffic, indexed pages with clean technical health demonstrate professionalism.

Build 5-10 quality backlinks from relevant sites. Guest posts, directory submissions, or genuine outreach. Avoid link schemes. Buyers check backlink profiles. One spammy link farm can tank your sale.

Fix all technical SEO issues: Proper title tags and meta descriptions, fast page load times (under 3 seconds), mobile responsiveness, SSL certificate installed, no broken links, XML sitemap submitted, robots.txt configured correctly.

Run Ahrefs or Moz to document your Domain Authority. Include this in your listing. DA 10-15 is acceptable for new sites. DA 20+ commands premium pricing.

Technical Excellence

Buyers want sites they can use immediately. These technical elements increase perceived value:

Hosting: Use reputable hosts like WPX, Rocket.net, or Kinsta. Budget hosts like Hostinger work if performance is solid. Avoid hosts with poor reputations.

Theme: Clean, modern, maintained themes. GeneratePress, Astra, or Kadence for WordPress. Avoid abandoned themes or obvious templates. Custom design adds value if it’s actually good.

Plugins: Essential only. Security, caching, SEO, and functionality plugins. No bloat. Twenty installed plugins signal poor site management. I keep mine under ten.

Performance: 90+ PageSpeed score. Under 3-second load time. Core Web Vitals passing. Use FlyingPress or WP Rocket for caching. Configure Cloudflare for CDN.

Security: SSL active, regular backups configured, security headers implemented, admin area protected. Install Sucuri or similar if selling an e-commerce site.

Document all of this. Screenshot your PageSpeed results, uptime monitoring data, and security scan reports. Include these in your Flippa listing.

Email Infrastructure

Set up professional email capture even if you have zero subscribers. Buyers see this as pre-built infrastructure they’d otherwise create themselves.

Use Mailchimp free tier, EmailOctopus, or Brevo (formerly Sendinblue). Connect it to your site with WPForms or Gravity Forms.

Create a lead magnet. Free PDF, checklist, or resource related to your niche. Buyers appreciate when conversion infrastructure exists even if it hasn’t converted anyone yet.

Visual Assets

Collect every visual asset you created:

- Logo (in multiple formats: PNG, SVG, AI)

- Favicon and touch icons

- Header images and hero graphics

- Product mockups (if e-commerce)

- Social media graphics

- Email templates

- Banner ads or promotional graphics

Organize these in a Google Drive folder. Include this in your sale package. Visual assets cost money to create. Buyers recognize this value even if the site makes zero revenue.

Process Documentation

Write down how the site works. This sounds basic but most sellers skip it. Create simple documents covering:

Content publishing workflow: Where to find post ideas, how to optimize articles, publishing checklist, internal linking strategy.

Technical maintenance: Backup schedule, update procedures, security checks, performance monitoring.

Growth plan: Your documented strategy for monetization. Even if you never executed it, buyers want to see you’ve thought through the path to revenue.

Time investment: 2-3 hours. Value added to sale: $300-500. Buyers pay more for sites with documented processes because it reduces their learning curve.

The Flippa Listing Process

Create your listing carefully. This determines whether you sell for $1,500 or $3,500 or more.

Pricing Strategy

Start 20-30% above your minimum acceptable price. Buyers expect negotiation. If you need $2,000, list at $2,400-$2,600. You’ll likely settle around $2,200-$2,300.

Consider auction versus fixed price:

Auction: Creates urgency, can drive prices up with multiple bidders, typically closes faster (7-14 days), works well for $500-$2,500 sites.

Fixed price: Attracts serious buyers, reduces negotiation fatigue, better for premium sites ($3,000+), gives you more control.

I prefer auctions for zero-revenue sites under $3,000. The competitive dynamic often pushes final price above what fixed-price listings achieve.

Set a reserve price at your absolute minimum. This protects you from selling too low if bidding is weak.

Writing Your Listing

Title: Clear, specific, keyword-rich. “Established Health & Wellness Blog – 25 Articles – Ready to Monetize” beats “Great Website For Sale.”

Summary (first 150-200 words): Lead with the strongest selling point. Business model, domain age, content volume, SEO foundation, or unique technical assets. Answer why someone should buy this instead of building from scratch.

Example:

This six-month-old health and wellness blog is ready for immediate monetization. 25 professionally written articles (1,500+ words each) cover weight loss, nutrition, and fitness. Clean backlink profile with DA 18. Fully configured WordPress site on reliable hosting. All visual assets, brand guidelines, and monetization strategy included. Skip the 3-month setup process and start driving traffic tomorrow.

Business model: Be honest. “Pre-revenue content site positioned for affiliate marketing and display ads” is better than pretending you have revenue when you don’t.

Traffic section: If you have zero traffic, say so but frame it positively: “New site with all articles indexed in Google. SEO optimization complete and ready for link building campaign.”

Monetization opportunities: List realistic income sources. For content sites: display ads (Mediavine/AdThrive once you hit traffic thresholds), affiliate marketing for relevant products, sponsored content opportunities, digital products or courses. For e-commerce: dropshipping from established suppliers, private label opportunities, affiliate partnerships, content marketing integration.

Don’t promise specific earnings. Describe potential pathways backed by industry norms.

Technical details: Full transparency. WordPress version, theme and plugins used, hosting provider, PageSpeed score, security measures, backup systems.

What’s included: Domain transfer, all content ownership, theme and plugin licenses (if transferable), visual assets and brand files, email list setup, process documentation, 30-day email support for technical questions.

Screenshots and Proof

Include 3-5 screenshots showing:

- Homepage design (demonstrates visual quality)

- Google Search Console data (proves indexing and technical health)

- Ahrefs or Moz domain overview (shows backlink profile and DA)

- PageSpeed Insights results (demonstrates performance)

- Admin dashboard or stats panel (transparency builds trust)

Annotate these screenshots. Add arrows and callouts highlighting key metrics. Most sellers just dump raw screenshots. Annotated images that tell a story command higher prices.

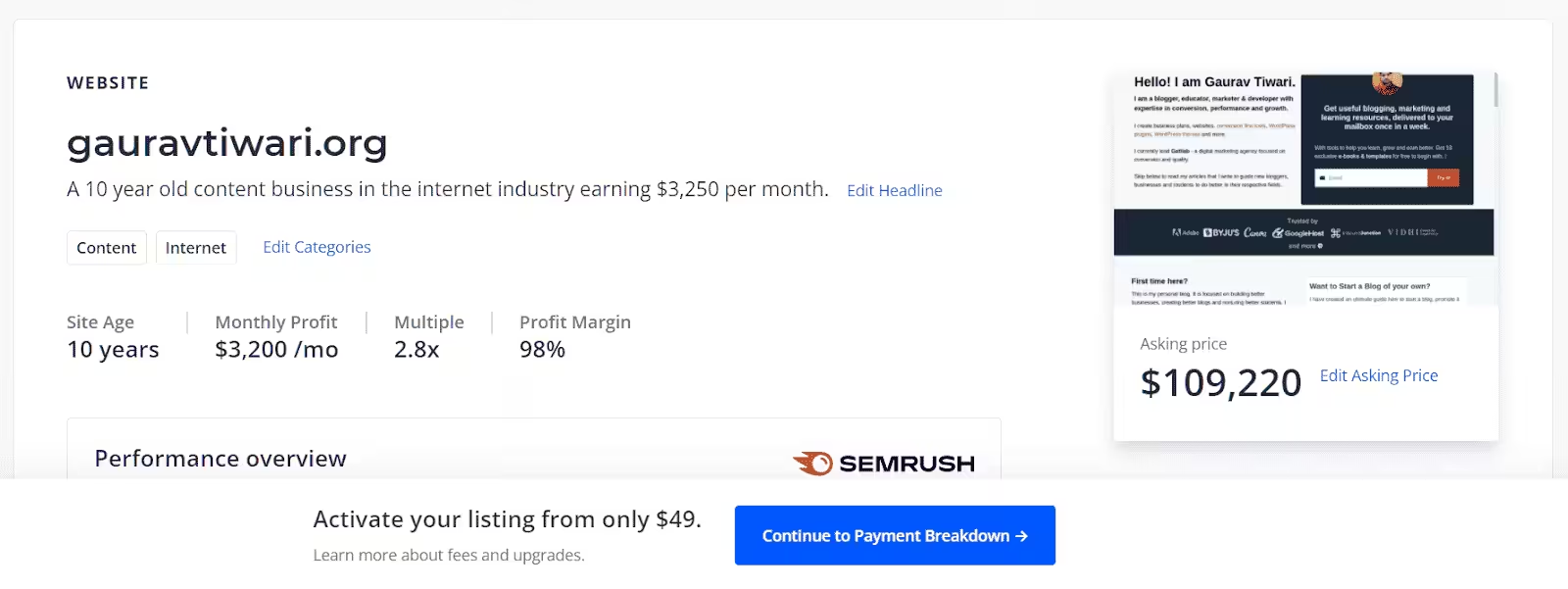

Listing Fees and Costs

Flippa charges $49 minimum listing fee. This is non-refundable whether you sell or not. Higher-tier listings with premium placement cost more ($99-$299) but typically don’t make sense for zero-revenue sites.

Success fee: 5% for sales over $100,000, 10% for sales between $50,000-$100,000, 15% for sales under $50,000.

On a $2,500 sale, you’ll pay $49 listing fee plus $375 success fee (15%), netting $2,076.

Factor these into your pricing. If you need $2,000 net, list at $2,350-$2,400 to account for fees.

Escrow and Payment

Use Flippa’s escrow service for all transactions. This protects both parties. The buyer deposits funds with escrow before you transfer the site. You transfer all assets, the buyer verifies everything works, then escrow releases payment.

Escrow fees: typically 2-3% split between buyer and seller. On a $2,500 sale, expect to pay $30-40 in escrow fees.

Never accept direct payment outside escrow. Even if the buyer seems legitimate. Scammers specifically target zero-revenue sites because sellers are often inexperienced with marketplace transactions.

Payment options to offer: Full cash upfront (simplest, most common for sites under $5,000), escrow-only (non-negotiable), seller financing (avoid for zero-revenue sites, too much risk).

Selling Without Traffic or Revenue

This is the hardest sell but absolutely possible. I’ve seen it work repeatedly when sellers position correctly.

What Buyers Actually Want

Speed to market. Your zero-revenue site still saves buyers 20-40 hours of setup work. Emphasize this in your listing. Don’t apologize for lack of revenue. Frame it as pre-revenue opportunity where all infrastructure is complete.

Proven concept validation. If your niche has successful sites, you’ve validated the concept by building in that niche. Link to successful competitors and explain how your site positions to capture similar audience segments.

Clean technical foundation. Buyers buying pre-revenue sites are DIY entrepreneurs. They’ll fix revenue problems themselves if the technical foundation is solid. Your job is demonstrating technical excellence.

Pricing for Zero-Traffic Sites

Realistic range: $500-$3,500 depending on:

$500-$1,000: Basic sites with 5-10 articles, minimal SEO work, generic design, under 3 months old.

$1,000-$2,000: Solid sites with 15-25 quality articles, proper SEO optimization, professional design, 3-6 months old, DA 10-15.

$2,000-$3,500: Exceptional sites with 25+ articles, DA 15-20+, custom design, comprehensive documentation, clear monetization roadmap, 6-12 months old.

Don’t price above $3,500 without traffic. Buyers won’t pay more regardless of how much work you’ve invested. The traffic threshold changes psychology significantly.

The Honest Pitch

I’ve found brutal honesty works better than hype. Buyers appreciate transparency.

Bad approach:

This amazing site is ready to explode with traffic! Just needs a little marketing!

Good approach:

Zero revenue currently. All content is published and indexed. SEO optimization is complete. The site needs link building and social promotion to drive traffic. If you have audience-building experience, this gives you a 6-month head start versus building from scratch.

The second approach attracts serious buyers who understand the work required. The first attracts tire-kickers who’ll waste your time.

Handling Objections

“Why hasn’t it made money yet?” Be honest. “I built this as a side project but don’t have time to drive traffic. All infrastructure is ready for someone who can commit to promotion.”

“Why should I buy instead of building?” “Building this took me 60 hours. The domain alone is 8 months old, which has SEO value you can’t buy. All content is written, optimized, and indexed. You’re paying for the 2-month head start.”

“Can you show any potential?” Point to similar sites in your niche making money. “Competing sites with this content volume typically earn $500-1,500 monthly from ads and affiliates once they hit 10,000 monthly visitors.”

Timeline and Expectations

Selling a zero-revenue site takes longer than selling a profitable business.

Realistic Timeline

Listing preparation: 5-10 hours if you have everything organized. Add technical improvements, document processes, create screenshots, write compelling listing copy.

Active listing period: 14-30 days for zero-revenue sites. Profitable sites sell faster. Be patient.

Negotiation: 2-7 days once you have a serious buyer. Expect back-and-forth on price, payment terms, and what’s included.

Escrow and transfer: 5-10 days. This includes payment verification, asset transfer, buyer verification period, and escrow release.

Total timeline: 1-2 months from deciding to sell until receiving payment.

Success Rates

Not every listing sells. Based on my observation of 200+ listings:

Sell successfully: 40-50% of well-prepared zero-revenue listings

Receive offers but don’t agree on price: 30-35%

No offers: 15-25%

Your odds improve dramatically with proper pricing, professional listing presentation, and realistic expectations.

What Kills Sales

Overpricing. Asking $5,000 for a 3-month-old site with no traffic. Price should reflect actual market comparables, not your emotional attachment or time invested.

Poor listing quality. No screenshots, vague descriptions, typos, missing technical details. Buyers assume sloppy listings mean sloppy sites.

Unrealistic claims. “Could easily make $10,000/month!” No data supporting this. Buyers see through hype immediately.

Technical problems. Broken links, slow loading, security warnings, poor mobile experience. Fix these before listing.

Lack of transparency. Hiding problems, avoiding questions, or being defensive about zero revenue. Honesty builds trust.

Alternatives to Flippa

Flippa dominates website sales but other options exist.

Motion Invest: Minimum $2,000 site value. They buy directly instead of listing on marketplace. Faster sale but lower price. They typically offer 20-30% below what open market might achieve. Good option if you want guaranteed sale and quick cash.

Empire Flippers: Minimum $100,000 sale price. Not realistic for zero-revenue sites. They focus on established, profitable businesses.

Private sale: Find buyer directly through networking, forums, or social media. No listing fees or success fees. Requires more effort and poses higher scam risk without escrow protection.

Facebook groups and forums: “Website Flipping,” “WordPress Website Sales,” and similar groups have active buyers. Free to post. More work to vet serious buyers. Always use escrow even for private sales.

For sites under $5,000, Flippa remains your best option. The platform provides credibility, built-in escrow, and the largest buyer pool actively looking for pre-revenue opportunities.

The Math of Selling Zero-Revenue Sites

Let’s make this concrete with real examples.

Example 1: Budget Content Site

Investment:

- Domain: $12

- Shared hosting (1 year): $60

- Free WordPress theme: $0

- Essential plugins: $0

- Your time writing 15 articles (30 hours @ $25/hour): $750

- Total: $822

Sale price: $1,200

Flippa fees: $49 + $180 = $229

Net profit: $971

Return on investment: 18% after accounting for time invested

Not spectacular but you’ve monetized work that would otherwise sit unused.

Example 2: Professional E-commerce Site

Investment:

- Domain: $12

- Managed hosting (1 year): $200

- Premium WooCommerce theme: $60

- Essential plugins: $100

- Product images and mockups: $150

- Your time on setup and customization (40 hours @ $30/hour): $1,200

- Total: $1,722

Sale price: $3,200

Flippa fees: $49 + $480 = $529

Net profit: $1,671

Return on investment: 97%

This demonstrates why e-commerce sites command premium pricing even without sales. The technical complexity and included assets justify higher valuations.

Example 3: Premium Content Site with SEO

Investment:

- Premium domain: $500

- Premium hosting (1 year): $300

- Professional theme: $100

- Premium plugins (security, SEO, caching): $250

- Professional logo and graphics: $200

- Your time writing 25 articles (50 hours @ $30/hour): $1,500

- Link building (10 quality backlinks): $200

- Total: $3,050

Sale price: $4,500

Flippa fees: $49 + $675 = $724

Net profit: $1,476

Return on investment: 48%

Lower percentage return but higher absolute profit. Premium domains and established backlinks justify the higher asking price even without traffic.

Making the Decision

Should you sell your zero-revenue site? Here’s how to decide.

Sell If:

You’ve lost interest. No amount of potential future earnings matters if you won’t do the work. Better to recover your investment and move to projects that excite you.

You need the capital. $2,000-$3,000 from a site sale can fund your next venture or pay down debt. Bird in hand beats potential future earnings.

You’ve built something good but lack promotion skills. Your technical and content creation skills produced a solid site. Someone else’s audience-building skills can make it profitable. That’s a fair transaction.

The niche isn’t working. You researched a niche that seemed promising but isn’t. Cut losses and move on rather than sinking more time into a weak niche.

Don’t Sell If:

You’re giving up too early. Most sites need 6-12 months of consistent content and promotion before traffic builds. Selling at 3 months means leaving money on the table.

You have audience-building skills. If you can drive traffic but haven’t yet, keeping the site and executing promotion probably yields more than selling. Someone buying your $2,000 site will likely turn it into a $500/month earner within 6 months.

You’re emotional about pricing. If you’re insulted by realistic market prices for zero-revenue sites, you’re not ready to sell. Wait until you can evaluate your site objectively.

The site has real potential you can execute on. A site in a profitable niche with solid foundation that just needs promotion is worth more to you than to buyers. Your insider knowledge of the niche and ability to execute gives you edge over buyers who must learn everything from scratch.

What Happens After You Sell

The transfer process determines whether you get good reviews and future sales opportunities.

Transfer Checklist

Within 24 hours of escrow payment:

- Transfer domain to buyer’s registrar (get auth code, unlock domain, confirm transfer)

- Export all content (WordPress export XML file, database backup, theme files, media library)

- Document all passwords (admin, hosting, email, plugins)

- Provide plugin license keys if transferable

Within 48 hours:

- Transfer hosting account or migrate site to buyer’s hosting

- Transfer email addresses and forwards

- Provide Google Search Console and Analytics access

- Share all visual assets and documentation

Within 72 hours:

- Verify buyer has successfully accessed everything

- Answer setup questions

- Provide promised 30-day support window contact information

Post-transfer:

- Request review on Flippa once buyer confirms satisfaction

- Keep documentation of transfer for your records

- Remain available for reasonable questions during support period

Support Expectations

Offer 30 days of email support for technical questions. This costs you nothing and dramatically improves buyer satisfaction.

What’s reasonable to support:

- “How do I update this plugin?”

- “Where did you host the logo files?”

- “Can you clarify this section of your documentation?”

- “The contact form isn’t working, can you check the configuration?”

What’s unreasonable:

- “Can you write 10 more articles for me?”

- “Will you run my Facebook ads?”

- “Can you teach me SEO?”

- “Fix this thing I broke after making major changes”

Set boundaries politely. You sold infrastructure and documentation, not ongoing consulting services.

Final Recommendations

Start here: List your site on Flippa. Use the free valuation tool as your baseline. Add 20-30% for negotiation room. Write an honest listing that emphasizes time savings and infrastructure value over imaginary future earnings.

Accept that selling a zero-revenue site means lower prices than you’d prefer. Your $60 of time investment doesn’t automatically translate to $4,000 sale price. Market determines value, not your effort level.

Price realistically, present professionally, transfer quickly. Do this and you’ll sell.

The alternative is letting the site sit unused while paying annual hosting and domain renewal fees. Recovering $1,500-$3,000 from something currently earning zero makes financial sense.

I’ve sold three zero-revenue sites on Flippa. Average time from listing to payment: 24 days. Average net profit after fees: $1,847. Total time invested in sale process per site: 12 hours.

That’s $154/hour for time I spent anyway building something I wasn’t using. Better than letting domains expire.

Frequently Asked Questions

Can I really sell a website with no revenue on Flippa?

Yes. Flippa processes hundreds of zero-revenue site sales annually. I’ve personally sold three sites with no earnings in the $1,500-$3,500 range. Buyers purchase time savings and infrastructure, not just revenue. A properly built site with quality content and solid SEO foundation has real value even without current earnings.

How much can I realistically sell my zero-revenue site for?

$500-$3,500 depending on quality factors. Basic sites with minimal content sell for $500-$1,000. Well-built sites with 20+ articles, proper SEO, and professional design sell for $1,500-$2,500. Exceptional sites with premium domains, strong backlinks, and comprehensive documentation reach $3,000-$3,500. Above $3,500, buyers expect traffic or revenue.

How long does it take to sell a zero-revenue website?

Expect 14-30 days for active listing period, plus 5-10 days for escrow and transfer. Total timeline from listing to payment: 3-6 weeks. Zero-revenue sites take longer to sell than profitable businesses. Proper pricing and professional presentation speed this up significantly. My average across three sales: 24 days from listing to payment received.

What fees does Flippa charge?

$49 minimum listing fee (non-refundable) plus 15% success fee on sales under $50,000. On a $2,500 sale, you’ll pay $49 listing fee plus $375 success fee, totaling $424 in fees. Escrow adds another 2-3% ($50-75 on a $2,500 sale). Total fees: approximately 19-20% of sale price for sites under $5,000. Factor this into your pricing strategy.

Do I need traffic to sell on Flippa?

No. I’ve seen dozens of zero-traffic sites sell successfully. Brand-new e-commerce sites with no visitors have sold for $3,500. Content sites with indexed articles but no traffic regularly sell for $1,000-$2,000. Buyers purchase potential and infrastructure. Your job is demonstrating why your zero-traffic site is worth buying versus building from scratch. Emphasize time savings, SEO foundation, and technical quality.

Should I use auction or fixed price listing?

Auction for sites under $3,000. The competitive dynamic drives prices up when multiple buyers bid. Fixed price works better for premium sites over $3,000 where you want to avoid underpricing. Set a reserve price at your absolute minimum to protect against weak bidding. I prefer 7-day auctions for zero-revenue sites. This creates urgency without dragging out the sale process.

What’s the minimum I should invest before selling?

$300-$1,500 depending on target sale price. For $1,500 sale: decent domain ($12), reliable hosting ($60-200), 15-20 quality articles (30-40 hours), basic SEO optimization, professional appearance. For $3,000+ sale: premium domain ($100-500), quality hosting ($200+), 25+ articles (50+ hours), documented backlinks, professional design, comprehensive documentation. Don’t over-invest hoping for higher sale price. Market sets value, not your investment level.

What are alternatives to Flippa for selling websites?

Motion Invest buys sites directly (faster but 20-30% below market value). Empire Flippers requires $100,000+ sale price (not viable for zero-revenue sites). Private sales through Facebook groups avoid fees but increase scam risk. For sites under $5,000, Flippa provides best combination of buyer pool, credibility, and built-in escrow protection. The fees are worth the reduced risk and faster sales.

Disclaimer: This site is reader‑supported. If you buy through some links, I may earn a small commission at no extra cost to you. I only recommend tools I trust and would use myself. Your support helps keep gauravtiwari.org free and focused on real-world advice. Thanks. — Gaurav Tiwari

Great tutorial, Gaurav! I think it is super cool that people who have spent some time developing a project without ever getting to revenue can actually still get something out of it by selling the site on to someone else! Additionally, founders do not need to always sell their entire websites. New marketplaces like https://www.bitsfordigits.com/ allow founders to only sell a piece of their website via partial buyouts!