What is PFMS? Significance & Benefits of PFMS

Public Financial Management System (PFMS) is a nationwide digital platform built by India’s Controller General of Accounts to streamline fund flow, track expenditures and support direct benefit transfer schemes. In this expanded guide, you’ll learn what PFMS means, why it was launched, how it works, and how this modern finance management tool can benefit you and society in 2026. I’ll break down its objectives, significance and major advantages so that you can understand how PFMS improves transparency, reduces delays, and ensures that government funds reach the right people quickly.

Table of Contents

Originally launched as the Central Plan Scheme Monitoring System (CPSMS) in 2009, the platform has since been renamed and expanded into the Public Financial Management System. Its mission is to create an efficient fund-flow network and real-time expenditure reporting across all central sector and centrally sponsored schemes. By connecting ministries, departments, state treasuries and banks, PFMS provides a unified decision-support system that helps the government plan, monitor and audit spending. As the system has matured, it has extended support for direct benefit transfer (DBT), meaning subsidies, scholarships, pensions and welfare payments can be sent straight to beneficiaries’ bank accounts without middlemen. This integration not only reduces leakages but also gives citizens and administrators instant visibility into where every rupee goes.

What is PFMS?

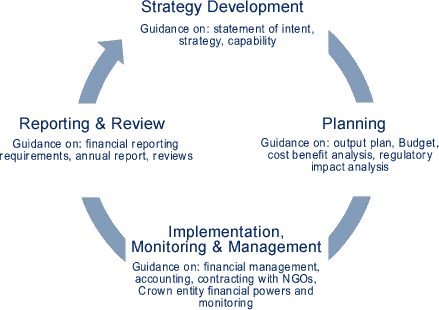

PFMS is a flagship reform initiative of the Ministry of Finance designed to bring India’s complex web of schemes and subsidies under a single digital roof. At its core, PFMS tracks every rupee released under Central Sector and Centrally Sponsored schemes, capturing how funds are allocated, released and spent. This granular view helps policymakers and citizens see which programs are working and where money is being deployed.

By providing real‑time dashboards and reports, PFMS ensures that money invested in social and development programs reaches its intended beneficiaries. It enables the government to monitor budget utilisation at each stage of implementation and quickly identify bottlenecks or anomalies.

All of this budgeting data is anchored in the Controller General of Accounts’ accounting system, making PFMS the official source for consolidated financial records across ministries and states.

Before PFMS, India’s accounting system struggled to support effective monitoring, consolidated reporting and planning. The existing processes were fragmented and manual. PFMS was conceived to fix those gaps by offering a transparent, digital ledger that unifies budgeting, accounting and payments.

Since its launch it has been rolled out across all central ministries and state governments. The project’s innovation even earned the Microsoft Developer Innovation & Excellence Award back in 2009.

PFMS integrates with the core banking systems of over 150 banks across India, acting as the central management information system for all Direct Benefit Transfer (DBT) transactions. This integration supports fast, secure and error‑free fund transfers.

More than eight hundred thousand implementing agencies and grantee institutions are registered on PFMS, ensuring accountability and traceability for each release.

Ultimately, the goal is to produce state‑wise and scheme‑wise statements that show how funds under centrally sponsored schemes are allocated, transferred and used, enabling better decision‑making and preventing misuse.

Why PFMS was formed?

India runs hundreds of welfare schemes and development programs across multiple sectors, from rural employment to healthcare. The central government releases huge sums of money every year and needs to ensure that these funds reach the intended beneficiaries. PFMS was established to keep a watchful eye on this flow of capital and to make budgeting more efficient. By centralizing payments and tracking, PFMS provides you and me with assurance that tax money is being spent wisely.

Earlier management information systems couldn’t give an accurate, real‑time picture of where funds were utilised. Reports were delayed and often incomplete, making it hard for the government to know if money remained unused or had been diverted. By the time the central authorities received the paperwork, the data was outdated. PFMS addresses this by providing live information on fund transfers, bank balances across districts and scheme‑wise utilisation details.

That gap led to the creation of PFMS as a mandatory mechanism for transparent public financial management. With PFMS in place, the government can plan better, respond quickly to changes on the ground and ensure that programmes deliver real impact.

Significance of PFMS

Today, PFMS is the backbone of India’s public finance architecture. It underpins how money flows from the Centre to states, districts and villages. Without PFMS, the government would struggle to manage the scale and complexity of modern welfare schemes.

Here are some of the key ways in which PFMS shapes our country’s financial landscape:

- PFMS ensures transparency by routing every rupee through accredited banks and linking the bank accounts of implementing agencies to a central portal. Every transaction—down to the last paisa—is recorded and visible to the central government, building trust and confidence in public finance.

- The system eliminates inconsistencies and delays in fund flow, reducing the scope for mismanagement. By providing clear audit trails and near real-time reconciliations, PFMS helps auditors and citizens keep a hawk’s eye on how funds are being used.

- To ensure funds are used as intended, PFMS establishes implementing agencies at the state, district and grassroots levels that are accountable for every rupee. These entities track receipts and expenditures, detect bottlenecks and flag underutilization or misappropriation before money goes down the drain.

- PFMS streamlines the release of grants and subsidies to NGOs, autonomous bodies and government ministries. Instead of sending checks into the wind, the system electronically credits registered bank accounts of agencies and beneficiaries, leaving no room for middlemen to siphon off funds.

- Traditionally, finance systems only booked the release of funds but rarely tracked how those funds were spent. PFMS flips the script by mandating recording of actual utilization and outcomes, fostering a culture of accountability and ensuring taxpayers see real results for their money.

- By minimizing idle balances (float) in bank accounts, PFMS improves cash and debt management. The system tightens fund flow and schedules transfers just when needed, which reduces borrowing costs and improves the government’s financial health.

- PFMS makes public information accessible to everyone by publishing data on releases and utilization through dashboards and regular reports. Citizens no longer have to guess where the money went; they can see it all online.

- As a decision-support system, PFMS offers online dashboards, analytics and real-time status of fund utilization. Policymakers can plan budgets, forecast cash flows and make evidence-based decisions at the click of a button.

- By forcing all transactions through banking channels, PFMS ensures money flows to the ultimate beneficiary. This builds trust, discourages corruption, and shows taxpayers a clear line from allocation to impact.

Benefits of PFMS

PFMS delivers a suite of benefits that go beyond accounting. It enhances transparency, accelerates payments, reduces leakages, and ensures that public money has maximum impact. The platform offers wide-ranging advantages for administrators, citizens and states—creating a seamless flow of funds, a clear audit trail and real-time information. The following sections break down the general benefits, benefits for citizens and benefits for state governments.

General Benefits

- PFMS automates the creation of sanction orders and draft sanction modules. This reduces manual data entry and the associated errors, saving time for government staff and ensuring sanctions are generated quickly and accurately.

- Sanction orders processed through PFMS are instantly accessible to state governments, implementing agencies and individual beneficiaries. Each stakeholder can trace their releases and confirm receipt without waiting for a physical dispatch.

- PFMS provides year-wise statements of releases, enabling ministries and agencies to compare current disbursements with previous years. This historical perspective helps with budget planning and ensures continuity across schemes.

- Comprehensive reports in PFMS track pending sanctions, issued sanctions and settled sanctions in real time. These monitoring tools help managers identify bottlenecks and expedite approvals, making the funding pipeline more efficient.

- After a sanction is approved, PFMS routes the transaction digitally to the drawing and disbursing officer (DDO) and then to the pay and accounts office (PAO) before it reaches the bank. This end-to-end trail ensures that each step—from bill processing to final payment—is transparent and accountable.

- The system clearly distinguishes between funds allocated, funds released and actual expenditure. Policymakers can tell at a glance how much money was sanctioned, how much was disbursed and how much was spent on the ground.

- PFMS generates daily and monthly reports on releases, investments and utilisation percentages. These analytics give stakeholders a bird’s-eye view of financial performance and help them adjust funding strategies proactively.

- The platform offers a unified interface where users can view sanctions and releases by scheme, agency, state or ministry across both special purpose vehicle and treasury routes. This granularity makes cross-comparison and analysis straightforward.

- PFMS flags agencies, including NGOs, that receive grants from multiple schemes or departments. This oversight prevents double-dipping and ensures funds are distributed equitably.

Benefits to Citizens

PFMS empowers ordinary citizens by giving them direct visibility and control over government welfare funds. Through alerts, direct benefit transfers and self-registration features, the system ensures that benefits reach those who need them without leakages.

- Registered citizens receive real-time alerts when funds are released to government facilities in their area. The alerts specify the amount, purpose and scheme, so residents know what’s planned for their community.

- PFMS supports direct payments under social sector schemes and conditional cash transfers. Money goes straight from the treasury to beneficiaries’ bank accounts, cutting out middlemen and reducing corruption.

- Citizens can self-register on the PFMS portal by providing basic details and their geographical location. This allows them to track benefits, verify transactions and participate in local monitoring.

- PFMS supports multiple payment modes including demand drafts, cheques, RTGS, ECS, online banking and printed advice. This flexibility accommodates users with varying levels of digital access.

The Citizen Information Portal offers an easy-to-use dashboard that displays state-wise releases, district-wise releases, scheme-wise details, agency registrations and investment data. Residents can quickly see where money is being deployed and hold authorities accountable.

- State-wise releases

- District wise releases

- Agency wise releases

- Scheme wise releases

- Information of all agencies registered

- Millennium development goals investment

- Sector-wise investment

- Flagship scheme investment

Benefits to State Governments

- PFMS gives state governments a unified dashboard showing every planning grant they receive via treasury transfers, special purpose vehicles, societies, autonomous bodies, NGOs and individuals registered in the state. This level of detail helps officials plan budgets, forecast cash flows and ensure that no funds fall through the cracks.

- It enables full implementation, monitoring and management of schemes at every level, making the entire programme lifecycle—from sanction to execution—visible online. Administrators can track progress, check compliance and troubleshoot issues without wading through paper records.

- The system offers transparent, searchable lists of all grants received from central ministries under various schemes. States can quickly verify the amount, date and purpose of each transfer and align it with local spending priorities.

- At the district and block level, agencies can generate unique sanction IDs and component‑wise investments within PFMS. These IDs are integrated with banking transactions and updated in real time, allowing finance officers to track each rupee from sanction to utilisation.

Official Website

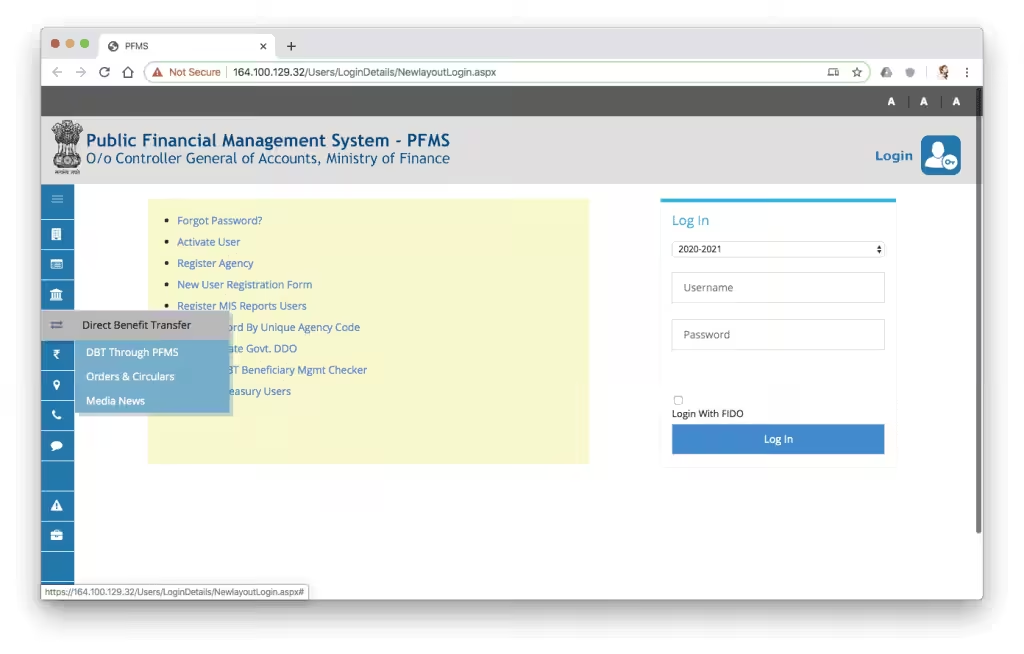

- The official PFMS website (https://pfms.nic.in) hosts a wealth of resources including scheme guidelines, training manuals, dashboards and news updates. It is the central hub for exploring the platform’s features and verifying releases.

- Registered users can log in through the portal (https://pfms.nic.in/Users/FidoLogin.aspx) to manage their accounts, track transactions, generate reports and update agency or beneficiary details. Access is secured to protect sensitive financial information.

Disclaimer: This site is reader‑supported. If you buy through some links, I may earn a small commission at no extra cost to you. I only recommend tools I trust and would use myself. Your support helps keep gauravtiwari.org free and focused on real-world advice. Thanks. — Gaurav Tiwari

सरकारी लाभ पाने के लिए।

PFMS

PFMS scheme kya hai aur iska benefit kaun aur kaise le sakta hai?

main confused hu kyonki payment kaise hoga sirf itna btaya gya hai lekin mere samjh me ye nahi aa rha ki pfms ke through kisi ke account me maine 800-2200 tak payment aaya hai. kabhi kabhi lagatar do din payment aaya hai kaise? samajhayiye.

Thanks for sharing this information , its detailed and too good since you have shared the screenshots of the entire method involved in the process . This is really good . Helpful !!

I have noticed that of all forms of insurance, health care insurance is the most questionable because of the turmoil between the insurance coverage company’s obligation to remain adrift and the client’s need to have insurance plan. Insurance companies’ revenue on health plans are extremely low, hence some corporations struggle to generate income. Thanks for the suggestions you discuss through this blog.