Pros and Cons of Adopting Crypto in Your Business

More businesses are looking at cryptocurrency as a real option for their operations. More than 6,000 businesses accept bitcoin as a means of payment, according to one estimate in early 2024. Bitcoin hit new highs in 2024, and many expect this trend to continue. Around 28% of Americans now own some form of cryptocurrency.

So should your business jump in? Here’s what you need to know about the real benefits and minor drawbacks of accepting crypto.

Table of Contents

Lower Fees and Faster Payments

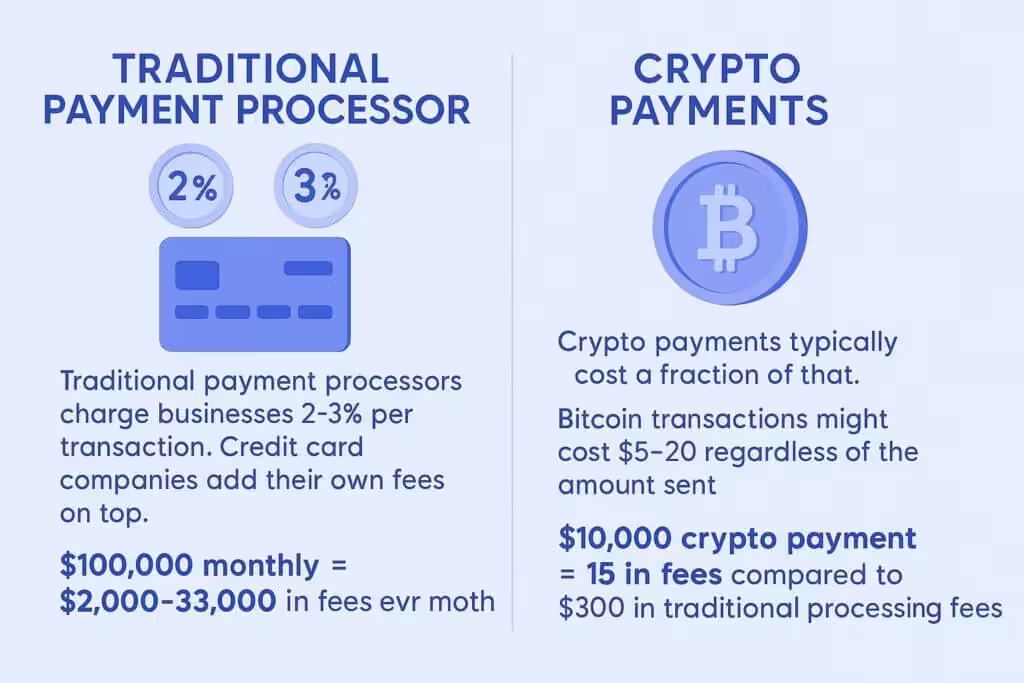

Traditional payment processors charge businesses 2-3% per transaction. Credit card companies add their own fees on top of the transaction fees. For a business processing $100,000 monthly, that’s $2,000-$3,000 in fees every month.

Crypto payments typically cost a fraction of that. Bitcoin transactions might cost $5-$20 regardless of the amount sent. For larger transactions, the savings become huge. A $10,000 crypto payment might cost $15 in fees compared to $300 in traditional processing fees.

International payments get even better. Bank wire transfers can take 3-5 days and cost $25-$50 per transfer. Crypto payments settle in minutes for the same low fee. Your business gets paid faster and keeps more money.

Some platforms offer crypto-to-fiat conversion instantly. You accept crypto from customers but receive dollars in your bank account. This gives you all the benefits without holding crypto directly.

Access to New Customer Markets

Crypto users represent a growing, tech-savvy demographic with disposable income. These customers actively seek businesses that accept their preferred payment method. Adding crypto payments can attract this valuable customer segment.

Many crypto holders prefer spending their digital assets rather than converting to cash first. They’ll choose businesses that make transactions easy and direct. This creates customer loyalty and repeat business.

International customers find crypto payments simpler than dealing with currency conversion and international banking fees. Your business becomes accessible to global customers without the usual payment complications.

Online Trading Platform Integration

Businesses dealing with cryptocurrency might benefit from professional trading tools like the popular futures trading tools popping up everywhere on online platforms. Top rated crypto futures trading platforms, for instance, offer advanced features for businesses managing larger crypto positions. These platforms provide hedging tools and risk management features.

Having access to professional trading infrastructure helps businesses optimize their crypto holdings and manage price volatility effectively.

Treasury Management and Investment Opportunity

Some businesses hold crypto as a treasury asset. Bitcoin has outperformed many traditional investments over the past five years. Companies like MicroStrategy have made significant profits holding bitcoin on their balance sheets.

You can accept payments in crypto and hold some as an investment. This diversifies your business assets beyond traditional cash and bonds. Even holding 5-10% of treasury in crypto provides diversification benefits.

Crypto holdings can hedge against currency devaluation. If your local currency weakens, crypto holdings might maintain or increase value. This provides some protection against inflation and monetary policy changes.

Smart Contract Automation

Blockchain technology enables smart contracts that execute automatically when conditions are met. This reduces administrative overhead and ensures precise transaction execution.

For subscription businesses, smart contracts can handle recurring payments automatically. Customers deposit funds once, and payments process without manual intervention. This reduces billing disputes and failed payments.

Supply chain businesses use smart contracts for automatic payments upon delivery confirmation. This speeds up the payment cycle and reduces disputes between parties.

Enhanced Security and Fraud Protection

Crypto transactions are irreversible once confirmed on the blockchain. This eliminates chargeback fraud that costs merchants billions annually. Credit card chargebacks can happen months after the original transaction, but crypto payments are final.

Blockchain technology provides transparent transaction records that can’t be altered. This creates clear audit trails for accounting and compliance purposes. Every transaction is recorded permanently and publicly verifiable, which is highlighted by a recent published study by ScienceDirect.

Crypto payments don’t require sharing sensitive customer data like credit card numbers. This reduces your business’s liability if payment data gets compromised. Customers share only their wallet address for transactions.

Growing Business Acceptance

Bitcoin’s upward trend, which started in 2023, gained momentum in 2024, pushing prices to new all-time highs and outperforming the S&P 500. This performance has increased business confidence in cryptocurrency adoption.

Major retailers, sports teams, and service providers now accept crypto payments. This mainstream adoption makes it easier for smaller businesses to justify adding crypto payment options.

Payment processors like BitPay, Coinbase Commerce, and others provide simple integration with existing point-of-sale systems. Adding crypto payments often requires minimal technical changes to current operations.

Real-World Implementation Tips

Start small by accepting crypto for online sales before adding it to physical locations. This lets you learn the process with lower-stakes transactions.

Use established payment processors rather than building your own crypto payment system. These services handle technical complexity and provide customer support. Also, consider which cryptocurrencies to accept. Bitcoin and Ethereum are most common, but some businesses benefit from accepting other popular coins their customers prefer.

Set clear policies for crypto payments, including refund procedures and customer support processes. While crypto transactions are irreversible, you can still provide excellent customer service.

Looking Forward

Crypto adoption continues growing among both consumers and businesses. Comprehensive cryptocurrency guides help business owners understand the technical aspects before implementation.

An increasing number of companies worldwide are using bitcoin and other crypto and digital assets for a host of investment, operational, and transactional purposes. This trend suggests crypto will become standard rather than exotic.

New tools and services make crypto integration easier each year. What required technical expertise five years ago now works through simple plugins and integrations.

Conclusion

The advantages of crypto adoption significantly outweigh the minor considerations for most businesses. Lower fees, faster payments, access to new customers, and potential investment gains create compelling reasons to accept cryptocurrency.

The technical challenges that once made crypto difficult for businesses have largely been solved by professional service providers. Modern crypto payment systems work as simply as traditional payment processing.

Start with a pilot program accepting crypto for a portion of your business. This lets you experience the benefits firsthand while managing any learning curve. Most businesses find the transition smoother than expected and quickly expand their crypto payment options.