5 Most Innovative Lending and Credit Platforms

Being that our financial systems run on technology, it’s no surprise that progress in software, data, and automation has completely reshaped how borrowing works today.

In the lending and credit ecosystem, manual reviews and paperwork-heavy loan approvals are slowly fading away. Banks, NBFCs, and fintech startups now rely on AI underwriting, risk scoring, credit analytics, and machine-learning powered loan decisions to accelerate approvals and reduce bias.

The shift is massive. In the last decade, the rise of digital lending platforms, embedded finance, BNPL providers, micro-credit apps, and alternative credit scoring models has opened access to capital for millions of users who were previously ignored by traditional lenders. Credit decisions that once took days now happen in under a minute.

The last few years saw a boom in fintech innovation. With open banking, instant KYC, blockchain-based loan disbursement, decentralized credit pools, and API-first lending infrastructure, the way individuals and businesses borrow money has forever changed.

In 2026, we are seeing even smarter credit scoring frameworks using cash-flow based analysis, behavioral risk modeling, open credit data frameworks (OCEN), and AI-driven loan orchestration systems. These aren’t just buzzwords. These platforms are rewriting how lending happens worldwide.

New-age LendTech companies are pushing the boundaries beyond traditional credit reports. Borrowers today get instant approvals, flexible repayment models, automated EMI calculations, BNPL credit lines, P2P lending options, small ticket consumer loans, and more.

With greater fintech penetration, the global credit market is evolving into a space that rewards transparency, speed, and personalization. And that is exactly where the most innovative tech players stand out.

In this article, we have listed the most innovative lending and credit platforms in 2026 and beyond, chosen for their real-world impact, advanced AI credit engines, and user-focused lending workflows.

Let’s explore the 10 best platforms leading the lending revolution.

Table of Contents

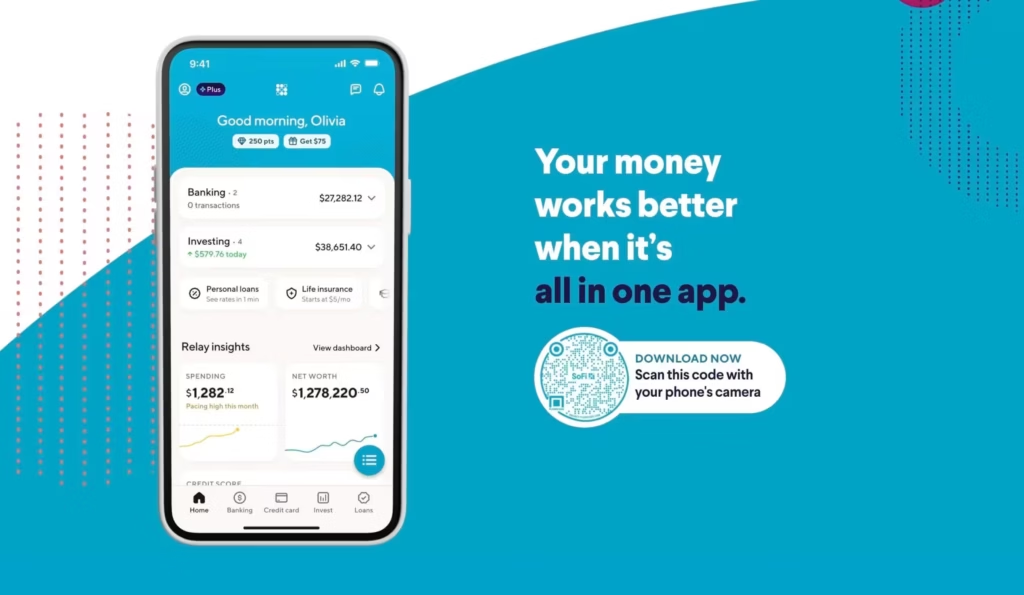

SoFi

SoFi started as the cool place to refinance student loans and slowly turned into a full financial ecosystem. Today, one user can have student loan refi, personal loans, credit card, investing, and everyday banking all inside a single app. The lending side still drives a lot of the business, but it is wrapped in a “member” story instead of a dry bank narrative.

What makes SoFi interesting for a list like yours is the way it connects products. Pay down your student loans, build a credit history, later move into a mortgage, and keep everything inside the same experience. It is part neobank, part digital lender, and part lifestyle brand. That mix of aggressive digital lending plus ecosystem thinking is a clear step ahead of most traditional banks stuck on siloed products.

Billd

Founded in 2018, Billd is the lending platform that comes with 120-day terms allowing contractors to easily access the tools and supplies they require in order to complete the projects while the suppliers can open up the new avenue to move products. Billd pays suppliers upfront, prior to shipping products to suppliers. As for builders, they never have to decline any projects because of cash flow. And the fact that they have 120 days in order to pay back their balance brings more equity to the whole building industry.

Stavvy

Founded in 2018, Stavvy aims to set a novel standard for digital servicing. This platform was designed by security, banking, and legal professionals for moving processes along much more swiftly when some modifications are needed for averting foreclosure. Remote signings, encrypted document transfer, videoconferencing, identity proofing as well as other additional tools are included within a platform, along with an ability to connect with notaries and signers online for granting power of attorney, sealing offer letters, and completing more tasks faster.

Avant

Founded in 2012, Avant uses fintech for simplifying a loan application process. After providing background information, selecting the loan option (home improvement, emergencies, debt consolidation, etc.), and signing the digital contract, a loan-seeker can expect to see money deposited into a bank account in just one day. Moreover, Avant uses the Avantcard as its newest fintech tool. This credit card helps a user access lines of credit for relatively smaller purchases, such as vacations or shopping, or larger payments for the home repair or new car.

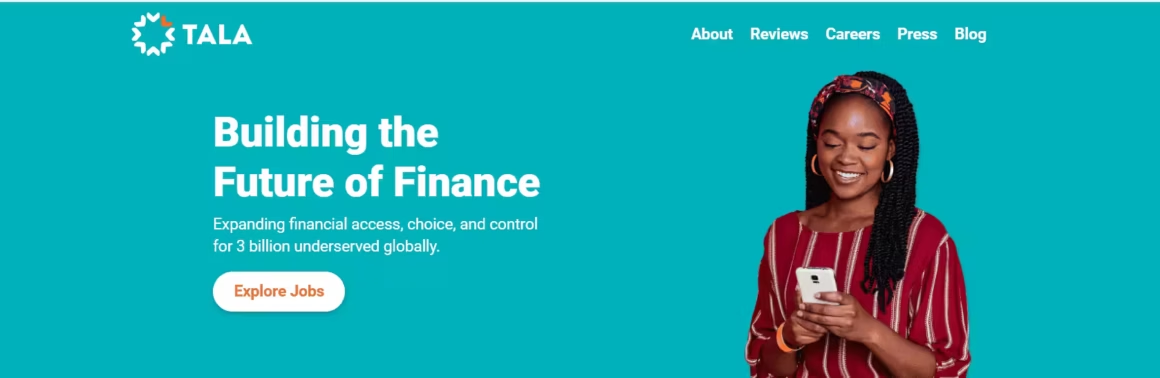

Tala

Located in Santa Monica, California, Tala uses big data in fintech so that it can financially serve the world’s traditionally under-banked areas. The consumer lending app of a company underwrites loans by using cell phone data, such as social connections, calls, bill payments, and texts to determine creditworthiness.

Tala also has teams in the Philippines, Kenya, Mexico, Tanzania, and India, working to secure loans for small business owners and individuals through alternative credit checks.

Klarna

Klarna is what happens when consumer credit stops looking scary and starts feeling like a product feature. It takes the old “pay later” idea and wraps it in a clean, app first experience that users actually like. Instead of throwing a full credit line at everyone, Klarna keeps it simple with pay in 4, pay in 30 days, or longer financing for big-ticket items.

The interesting part is how invisible the lending layer feels. For shoppers, it is just another option at checkout. For merchants, it quietly boosts average order value and conversions while Klarna takes the risk. Under the hood, real time data checks and risk models are doing heavy lifting, but the user never sees that. If you want a textbook example of how UX can completely change how people think about credit, Klarna is a solid pick.

Affirm

Affirm plays in the same buy now, pay later space, but with a very different tone. Where Klarna leans into lifestyle and shopping vibes, Affirm feels more like a straight talking finance partner. You see your total cost upfront, know exactly what you will pay, and there are no late fees hiding in the small print. That honesty is the product.

Affirm lets people split purchases into short interest free plans or longer EMI style payments with clear APRs. Merchants still get paid immediately, users get flexibility, and Affirm sits in the middle managing underwriting and collections. It is innovative not just because of the tech, but because it tries hard not to behave like a traditional credit card company. If your article talks about trust in modern lending, Affirm deserves a spot without question.

Upstart

Upstart is where lending and machine learning really meet. Instead of judging people only on a credit score, it looks at things like education, income pattern, job history, and other signals to model risk. The promise is simple. Approve more good borrowers, reject fewer people for silly reasons, and keep default rates under control.

Banks and credit unions can plug into Upstart’s platform and use its models for personal loans and other products. For them, it is like renting a smarter credit engine without rebuilding everything in house. For users, it usually means faster approvals and in many cases better pricing than old school score based systems. You do not see the AI, but you feel its impact in the approval decision. That is exactly the kind of quiet innovation your piece should highlight.

Funding Circle

Funding Circle focuses on one group that has always struggled with credit friction. Small and medium businesses. Instead of sending them through months of paperwork and branch visits, it moves most of the process online and uses data to speed up decisions. Business owners can apply for term loans and working capital, upload their documents digitally, and get a decision much faster than from a typical bank.

Behind the scenes, Funding Circle operates more like a marketplace, connecting capital providers with vetted businesses. That spreads risk, increases access, and makes the whole thing more efficient. It is not trying to be a flashy fintech super app. It is just solving a very real lending problem for SMEs that sit between big banks and expensive alternative finance. That focus makes it a strong, business side counterweight to your consumer heavy examples.

Kiva

Kiva is the heart driven outlier that still absolutely qualifies as an innovative lending platform. It lets everyday people anywhere in the world lend small amounts to entrepreneurs, students, and communities in places that traditional banks usually ignore. You browse real stories, pick who you want to support, and fund part of their loan with as little as a few dollars.

Most loans on Kiva are zero interest for the lender. People use it more for impact than profit. But the structure is still pure lending. There is a platform, there are field partners on the ground, and there is real credit risk being managed.

What makes it powerful is the way it turns abstract “financial inclusion” into something personal and actionable. Adding Kiva to your list signals that innovation in credit is not just about growth and convenience. It is also about who gets to participate in the first place.

FAQs

What are innovative lending and credit platforms?

Innovative lending and credit platforms are modern, mostly digital services that reimagine how people and businesses borrow money or get access to credit. Instead of long forms, branch visits, and slow approvals, these platforms use apps, APIs, alternative data, and automation to make the whole process faster, simpler, and more transparent. Some focus on buy now, pay later at checkout, some on AI driven underwriting, and others on impact lending or small business funding.

How are these platforms different from traditional banks?

Traditional banks usually rely on older systems, heavy paperwork, and strict score based credit rules. Innovative platforms strip all that down. They use real time data, cleaner user interfaces, and focused products to make borrowing feel more like using a good app than arguing with a branch manager. Many of them plug into merchants or partners directly, so lending becomes an invisible part of shopping, studying, or running a business instead of a separate painful process.

Are buy now, pay later services like Klarna and Affirm safe to use?

Buy now, pay later services like Klarna and Affirm are generally safe if you use them with discipline. They are regulated in many markets, work with known merchants, and show you clear repayment schedules before you confirm. The real risk is not the platform itself but overspending. If you keep track of your installments, avoid stacking too many plans at once, and treat BNPL like a short term tool instead of free money, it can be a useful and flexible way to manage bigger purchases.

Do these platforms still check my credit score?

Most innovative lending platforms still look at your credit profile in some form, but how they use it can be very different. Some do only a soft check that does not hurt your score. Others, like Upstart, blend your credit bureau data with extra signals like education, income pattern, and job history. A few BNPL checkouts may approve small limits with limited checks at first and then tighten or expand limits based on how you pay. Always read the terms so you know what kind of check they run.

Can small businesses benefit from these lending platforms?

Yes, small businesses are actually one of the biggest winners here. Platforms like Funding Circle are built around SME lending and aim to cut the time, friction, and guesswork that comes with bank loans. Instead of multiple branch visits, businesses can apply online, upload documents digitally, and get a decision faster. Access to cleaner term loans and working capital at fairer rates can be the difference between staying stuck and actually growing the business.

What role does AI play in platforms like Upstart?

In platforms like Upstart, AI sits at the core of the credit decision. Instead of relying on a single score, the model learns from thousands of data points and past outcomes to predict default risk. This can help approve more good borrowers who would otherwise be rejected under old rules, while keeping losses in control. For the user, AI just looks like faster approvals and sometimes better pricing. The heavy math runs in the background so the experience stays simple.

Are these new age lending platforms regulated?

Most serious lending and credit platforms operate under the same or similar regulations as traditional lenders in their markets. They still need licenses, must follow KYC and AML rules, and have to respect consumer protection laws. What changes is the delivery model, not the legal responsibility. That said, rules around areas like buy now, pay later and AI based underwriting are still evolving, so you should always check the platform’s licensing, terms, and country specific protections before you rely on it heavily.

How do platforms like Kiva support financial inclusion?

Platforms like Kiva open the door for borrowers who sit completely outside traditional banking systems. They let everyday people pool small amounts of money into microloans for entrepreneurs, students, and communities in underbanked regions. By working with field partners, these platforms can reach people who have no formal credit file but do have real businesses or education needs. The goal is less about high returns and more about giving people a fair shot at growth where banks see only risk.

Can I use multiple lending or credit platforms at the same time?

You can use multiple platforms at once, and many people do. But that is where trouble usually starts. Different apps, BNPL plans, cards, and personal loans can add up quietly in the background. On paper each payment looks small, but together they crush your cash flow. If you want to use more than one platform, track everything in one place, know your total monthly outflow, and be honest about what you can really afford. Convenience should not turn into chaos.

What should I check before choosing a lending or credit platform?

Before you commit to any platform, check a few basics. Look at the total cost of borrowing, not just the monthly payment. Read how fees, penalties, and late charges work. Confirm if they report to credit bureaus and how that affects your score. Check if the brand is regulated in your country and has a track record that is more than just good ads. Finally, ask yourself a simple question: does this loan actually move me forward, or am I just paying extra for something I could skip right now?

Conclusion

The lending and credit platforms space has changed fast, and it’s only getting more interesting.

Traditional banks aren’t the only place to borrow anymore, and honestly, they’re no longer the default choice for millions.

Today, digital lending apps, AI-powered underwriting systems, credit-scoring tools, and BNPL platforms are making access to credit faster, easier, and more inclusive.

In 2026, you’re not filling long forms or waiting weeks for approval — decisions often arrive in minutes because machine learning models evaluate your profile in real time.

We’re also watching a rise in micro-lending, cash-flow based underwriting, and alternative credit scores that don’t rely only on old-school CIBIL or bureau data.

Income patterns, online transactions, utility payments, work history — everything counts now, and that’s a huge win for people who were underserved earlier.

Security and transparency are becoming the deal-breakers.

Platforms that offer end-to-end encryption, regulatory compliance, fixed repayment clarity, and no hidden charges will stand out while those relying on shady fees will fade out faster than they rose.

If you’re exploring the best way to borrow, track, or manage your credit, this is the time to be smart and proactive.

Compare interest rates, repayment terms, late-fee policies, and check whether the app offers features like credit-building, instant withdrawals, EMI flexibility, or zero-cost loan conversion.

The fintech market is now crowded with innovation — from BNPL ecosystems, peer-to-peer lending, SaaS-based credit management dashboards, to AI lending platforms partnering with NBFCs for quicker disbursement and fraud control.

You get more power as a user because competition forces lenders to price better, respond faster, and stay transparent.

So while earlier getting a loan meant paperwork and waiting, today it’s about tapping your screen and evaluating smart options that match your goals.

Pick platforms that align with your risk appetite, spending style, and repayment confidence — not just the one offering the quickest cash.

I’ve covered plenty of options here, and each platform brings something valuable to the table.

Your needs decide which one makes the cut.

In 2026 and beyond, the winners will be those offering responsible lending, fair credit access, and consumer-first financial tools — and as a borrower, you deserve nothing less.