10 Best Loan Apps for Students in India in 2026

Students often encounter financial difficulties when trying to cover their educational costs. Whether it is for tuition fees, accommodation, pursuit of higher education, accommodation, travel expenses, coaching, or food, they need to opt for personal loans.

In this matter, student loan apps can prove to be very useful.

These apps have become popular in India as a result of the growing demand for education and personal financing among students. They provide an accessible and convenient way for students to apply for loans and cover various educational expenses such as textbooks, tuition fees, living expenses, and more. They play a crucial role in resolving the financial constraints that many students face when pursuing higher education.

Several loan apps are currently available in India, but not all of them align with students’ unique needs. Student loan apps are a wonderful option because they provide quick funds and a straightforward loan approval process. Moreover, in some cases, they don’t necessitate collateral and can be secured even without a credit history.

Today, numerous student loan apps in India help students get the financial assistance they require. In this article, I will discuss the top 10 best student loan apps currently available.

10 Best Loan Apps for Students in India

Let us now go through my picks for the ten best loan apps for Indian students today.

Table of Contents

Related guides: Earn with Chegg · Chegg Alternatives · Sites That Pay for Homework · Money Earning Apps

1. mPokket

mPokket is one of the fastest loan apps that provides quick loans to students whenever they are short of pocket money or urgently require a cash loan in an emergency. It also offers four-month, short-term personal loans up to a maximum amount of ₹45,000, which is directly credited to your bank account. Students nationwide can use a legitimate college ID and address proof to avail of this loan easily.

- Education loan: ₹500 – ₹30,000

- Student age: 18 years and above

- Repayment period: 61 days – 120 days

- Interest rate: 1% – 4% per month

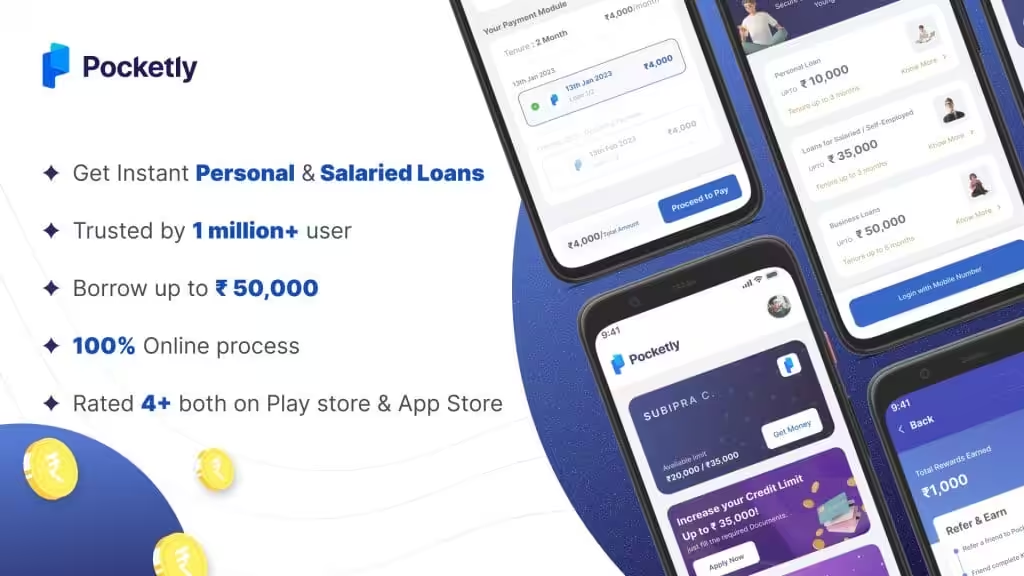

2. Pocketly

Pocketly offers instant personal loans to college students and salaried individuals who don’t have enough pocket money or require some quick cash. It offers instant loan amounts from ranging ₹500 to ₹10,000. The app has a flexible repayment tenure of 61 to 90 days. Its interest rates range from 1% to 3% per month. Also, a relatively low processing fee of ₹20 to ₹120 + GST is applicable.

- Education loan: ₹500 – ₹50,000

- Student age: 18 years – 30 years

- Repayment period: 2 months – 12 months

- Interest rate: 1% – 3% per month

3. PaySense

PaySense is a popular loan app meant for all needs, including education. Loans from PaySense have enabled thousands of students to pursue their dreams sans financial constraints. Apart from ensuring quick loan approval and disbursal, PaySense has decreed that educational loans below ₹4 lakhs won’t require any collateral, security, or third-party guarantee.

- Education loan: ₹5,000 – ₹5,00,000

- Student age: 18 years – 35 years

- Repayment period: 5 years – 12 years

- Interest rate: 8.5% – 11% per annum

4. KreditBee

KreditBee is among the best new loan apps for students in India. It aims to provide quick funds to college students and salaried individuals. The entire process – from application to issuance of the loan –takes place online, and KreditBee guarantees loan disbursement within ten minutes.

As of now, the app provides three different types of loans, in which the “Flexi Personal Loan” is meant for students who close to graduation or wish to pursue higher education.

- Education loan: ₹1,000 – ₹4,00,000

- Student age: 21 years – 50 years

- Repayment period: 3 months – 60 months

- Interest rate: 1.02% – 2.49% per month

5. CASHe

As their name suggests, instant loan apps like CASHe are meant to provide quick loans and make the application process more convenient. Any salaried individual earning at least ₹15,000 per month is eligible to avail student loans from CASHe. Not only is the process is fully digital and paperless, but it doesn’t require the borrower to provide a credit history while applying for the loan.

- Education loan: ₹1,000 – ₹50,000

- Student age: 21 years and above

- Repayment period: 3 months – 36 months

- Interest rate: 12% – 30% per annum

6. KrazyBee

KrazyBee is among the best student loan apps in India. It aims to help college students in some Indian cities make online purchases via a flexible monthly payment plan. Any student above the age of 18 from KrazyBee’s listed colleges is eligible to make a purchase from KrazyBee. As of now, it has offices in Bangalore, Mumbai, Hyderabad, Mysore, Pune, and Vellore.

With KrazyBee, you can easily place orders by browsing through KrazyBee’s catalog of products on your browser/app and making a purchase. Alternatively, you can browse through your favorite e-commerce store and use it to buy products on the KrazyBee website. Presently, the maximum limit of purchase on KrazyBee is ₹ 2,000 per month.

KrazyBee also offers four EMI plans: 3 months, 6 months, 9 months, and 12 months.

7. RedCarpet

RedCarpet is an excellent instant loan app for students that provides funding for education without considering their credit history. It also offers loans with higher credit limits.

Additionally, RedCarpet offers a Ruby Card to customers taking personal or student loans. The loan amount is disbursed in cash to the Ruby Card, making it easy to withdraw funds. Students can withdraw up to $1000 from the card without any transaction fees.

Furthermore, RedCarpet includes a spending tracker to monitor and manage expenses and card account activity.

8. IIFL Loans

Apart from being one of the best loan apps for students, IIFL Loans is also India’s largest non-banking finance company. It has earned a glowing reputation for offering student loans as low as ₹5000. With low interest rates, hassle-free documentation, and fast application processing, it has emerged as a popular choice for all types of loan needs.

IIFL Loans app has also grown in popularity by providing flexible EMI and easy repayment methods to students.

9. BadaBro

BadaBro is among the most preferred loan apps for college students. It offers instant loans to both college students and salaried professionals aged above 18 years. You can use it to receive an instant personal loan of up to ₹10,000 that is promptly disbursed to your bank or Paytm account.

The app offers a pretty flexible repayment tenure of 61 to 90 days. Its interest rates range from 1% to 6% per month, while its processing fee ranges from ₹34 to ₹203 + 18% GST.

10. Buddy Loan

Buddy Loan is a popular loan app that offers personal loans to students in India. With this app, you can borrow an amount up to ₹15 lakhs. Moreover, the app offers flexible repayment options, including EMI payments. It also offers instant loan approval, thereby making it a great choice for students who require money quickly.

Overview

| App | Loan Amount | Interest Rate | Repayment Tenure | Processing Fees | Unique Features |

|---|---|---|---|---|---|

| mPokket | ₹500 – ₹30,000 | 1% – 6% per month | 61 – 120 days | ₹34 – ₹203 | Instant disbursement, credit limit increases with repayment history |

| Pocketly | ₹500 – ₹10,000 | 3% – 5% per month | Up to 60 days | 1% – 2% of the loan amount | Student-focused, quick approval, flexible repayment options |

| PaySense | ₹5,000 – ₹5,00,000 | 1.4% – 2.3% per month | 3 – 60 months | 2.5% – 3% of the loan amount | No credit score required, instant loan eligibility check |

| KreditBee | ₹1,000 – ₹3,00,000 | 1.5% – 2.49% per month | 3 – 24 months | 2.5% – 6% of the loan amount | Minimal documentation, fast approval, multiple loan types |

| CASHe | ₹7,000 – ₹3,00,000 | 1.75% – 2.5% per month | 3 – 18 months | 2.5% of the loan amount | AI-based credit evaluation, no physical documents required |

| KrazyBee | ₹1,000 – ₹2,00,000 | 2% – 3% per month | 3 – 12 months | Up to 3% of the loan amount | Student loans, multiple loan categories, instant disbursement |

| RedCarpet | ₹1,000 – ₹60,000 | 1.5% – 3% per month | 1 – 12 months | 2% – 3% of the loan amount | Student-focused, quick processing, discounts for on-time repayments |

| IIFL Loans | ₹5,000 – ₹2,00,000 | 1.5% – 2.5% per month | 3 – 36 months | 2% of the loan amount | Wide range of financial products, quick disbursal, easy EMI options |

| BadaBro | ₹500 – ₹20,000 | 2% – 4% per month | Up to 6 months | 1.5% – 3% of the loan amount | Student-specific, fast approval, rewards for timely repayments |

| Buddy Loan | ₹10,000 – ₹15,00,000 | 1.5% – 2.3% per month | 6 – 60 months | 1% – 3% of the loan amount | Personal loan focus, quick eligibility check, minimal documentation |

Please note that the specific terms and conditions, including interest rates and fees, may vary based on the applicant’s profile and the lender’s policies.

FAQs

Which loan apps are best for students in India?

Top-rated student loan apps in India include mPokket, KreditBee, Pocketly, CASHe, Buddy Loan, and PaySense. These are popular for their fast approvals, flexible repayment options, and minimal documentation.

Can students get loans without a credit score?

Yes, most student-focused loan apps like mPokket and Pocketly do not require a credit history. They approve loans based on your college enrollment and basic ID verification.

How much loan can a student get from these apps?

Students can usually borrow between ₹500 and ₹50,000. Some platforms like Buddy Loan and CASHe may offer higher limits depending on repayment capacity or guarantors.

What documents are needed to apply for a student loan?

Typically, you’ll need a valid college ID, Aadhaar card, PAN card, and bank account details. Some apps may require a selfie or live verification for fraud prevention.

Are these loan apps legal and safe to use?

Yes, if the app is backed by an RBI-registered NBFC and listed on official app stores. Always read user reviews and terms before applying. Avoid apps not registered with the RBI or that ask for unusual permissions.

What is the interest rate on student loans via apps?

Interest rates vary from 12% to 36% per annum. Apps like KreditBee and PaySense offer competitive rates, but it depends on your profile and repayment terms.

How quickly is the loan disbursed after approval?

Disbursal is often instant or within 24 hours. Apps like mPokket and KreditBee claim to credit the amount within 10–30 minutes after verification is complete.

Student loan apps aim to give students a hassle-free way of securing funds for their educational pursuits, making higher education more accessible to a wider range of individuals. These loans help reduce the financial burden on the students and also give them an opportunity to build a good credit score by making on-time repayments, helping them qualify for other types of loans in the future.

However, you must remember to use these apps wisely and responsibly. Before signing up for one, you should exercise caution, read through the terms and conditions carefully, and make an informed decision to ensure a positive experience.

Disclaimer: This site is reader‑supported. If you buy through some links, I may earn a small commission at no extra cost to you. I only recommend tools I trust and would use myself. Your support helps keep gauravtiwari.org free and focused on real-world advice. Thanks. — Gaurav Tiwari