The Simple Math Behind Long Term Growth

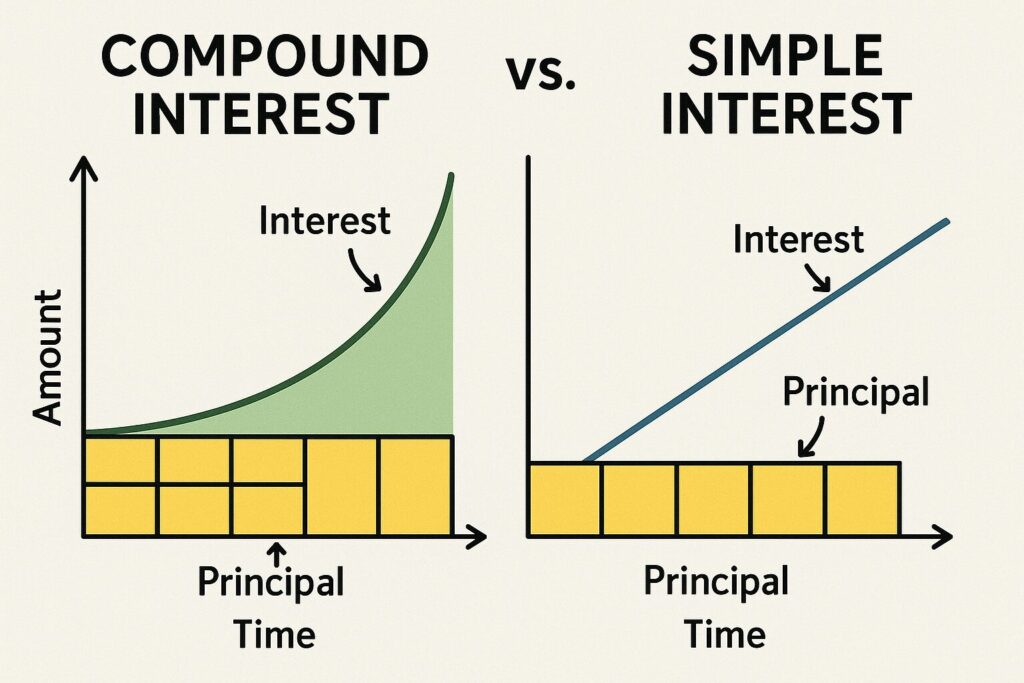

Compound interest plays a measurable role in long term savings. Your balance grows when you earn interest on your initial deposit and on the interest added over time.

This cycle strengthens your financial position. You gain more control over your goals when you understand how it works.

Table of Contents

Why Compound Interest Matters

Compound interest rewards consistency. You see stronger results when you stay committed to regular contributions.

Small increases in time or rate influence your final balance. A higher rate produces faster growth. A longer time horizon produces larger returns. Regular deposits help you build a stronger base.

A simple example shows the scale of the effect. A deposit of 5,000 dollars with a 6 percent annual rate for 15 years produces roughly 11,966 dollars.

Add monthly deposits of 100 dollars and the balance grows to more than 34,000 dollars. Each contribution increases the amount that earns interest. Your gains rise without extra effort on your part.

You strengthen your financial habits when you study numbers like these. You understand the outcome of each choice. You position yourself to make informed decisions.

How Time and Rate Influence Your Results

Time influences growth more than any other factor. The earlier you start, the higher your total. Even small deposits produce measurable gains when you allow them to grow for many years.

Your rate matters as well. Higher rates increase your growth each year. A small difference in the rate produces major changes across long periods.

For example, 10,000 dollars at 5 percent for 20 years grows to about 26,533 dollars. Raise the rate to 7 percent and the balance rises to about 38,697 dollars. This change does not require more deposits. It reflects the impact of a stronger rate.

Your deposit schedule also affects the outcome. Consistent monthly deposits create discipline. They also increase the total balance that earns interest.

Reviewing these elements helps you build steady habits. You understand why patience and structure give you stronger long term results.

How to Estimate Your Growth

You improve your planning when you use an interest rate calculator. It helps you test changes in time, rate, and deposit amount. You see immediate differences in projected growth. You understand how each decision influences your final number.

Online tools give you quick calculations. You enter your deposit, your timeline, and your rate. You add your monthly contribution if you plan to make one.

The tool shows your projected balance and the interest earned over the period. You see both the principal and the growth. This helps you compare scenarios and adjust your strategy.

A calculator supports clear decision making. It keeps you focused on your goal. It helps you stay consistent with your plan.

How to Apply Compound Interest to Your Goals

You apply compound interest across many situations. Long term savings benefit the most. Retirement accounts grow steadily when funded each month. Emergency funds grow when you let deposits sit untouched. Education savings accounts follow the same pattern.

You build structure when you set a timeline. A clear target keeps your progress measurable. You reduce impulsive changes that weaken your long term results.

You strengthen your position when you follow these steps.

- Set a specific goal.

- Choose a timeline that supports the goal.

- Review rates from reliable financial institutions.

- Automate contributions.

- Measure your progress each quarter.

You adjust your plan based on real numbers. You increase contributions when your income rises. You decrease them temporarily when unexpected expenses appear. The important point is consistency across the full timeline.

Your confidence grows with each review. You see your progress. You understand your choices. You stay committed to the plan.

Building Stronger Financial Habits

Compound interest supports long term thinking. You improve your financial stability when you stay focused on structure, time, and consistency.

You make stronger decisions when you know how each variable influences growth. You understand the value of early action. You use tools that give you accurate projections. You measure your progress. You adjust your plan as needed.

You stay in control of your goals when you follow clear steps. You keep your savings organized. You give each dollar a purpose. You turn consistent action into measurable long term results.